Blooma Stark Presenting "Life Cycle of a Trust" at An Illinois CPA Society Breakfast Meeting

11.29.17

On Friday, December 8, Aronberg Goldgehn member Blooma Stark will present “Life Cycle of Trust” at the CPA/JD Practitioners’ Breakfast hosted by the Illinois CPA Society.

Blooma will present from 8 a.m. to 9:15 a.m. Breakfast and registration begin at 7:30 a.m.

Topic Overview

Many people have trusts and, as they age, their estate planning documents will become more complicated. Though CPAs and lawyers may have previously taken courses on the income taxation of trusts and estates, this course will focus on a common estate planning tool—a revocable trust with marital deduction planning. The presentation focuses on the trust during the taxpayer’s lifetime (a living trust). And, the presentation will walk attendees through the taxation and reporting requirements for a marital deduction trust (and currently A/B/C/D trusts).

While Subchapter J governs the taxation for trusts and estates, the application of it differs depending on the type of trust. In this presentation, attendees will learn the primary vehicles for basic estate planning using trusts, how to report income for basic trusts, how marital deduction planning works at the first death, and much more.

The continuing education learning objectives for this course will be for attendees to be able to identify the types of trusts, describe and recognize a living trust, describe and recognize an A/B (and C/D) trusts, outline the life cycle of a living trust during the lifetime of the grantor, identify the filing elections for a living trust, identify the changes in treatment of a living trust at the death of the grantor, outline the life cycle of an A/B trust, describe the requirements for each part of an A/B trust, and correctly describe the filing requirements for an A/B trust.

Continuing Education Credit

- CPE: 1.5 hour

- CLE: 1.25 hour

Location

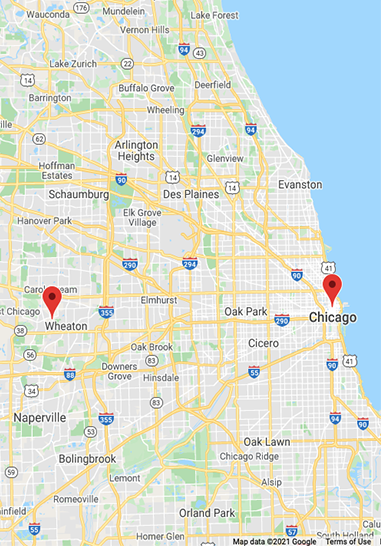

The Hilton Lisle/Naperville, 3003 Corporate West Drive, Lisle, IL 60532-3603

Cost

$30 plus your professional business card at the door and includes a full buffet breakfast. Early registration is always encouraged.

Registration

Pre-registration is encouraged to Aaron E. Ruswick at Huck Bouma P.C. at 630-221-1755. Payment can be made when you check in on September 8thth. Make your check payable to the “Fox Valley Chapter ICPAS.” Cash or check accepted at the door.

If you have any questions about this event, please contact the Professional Practitioners Networking Co-Chairpersons, Aaron E. Ruswick at 630-221-1755 or aruswick@huckbouma.com and/or Daniel P. Vargo at 630-836-3003 or dvargo@vargocpa.com.

About the Speaker

Blooma Stark is a lawyer and CPA who focuses her practice on estate planning and probate with particular emphasis in the areas of tax planning, asset protection planning and elder care planning. She is a member of the Chicago Bar Association and is a former Chair of the Trust Law Committee, as well as a member of the Illinois and American Bar Associations and the Chicago Estate Planning Council. Blooma has spoken before many community and professional organizations including the Illinois Institute for Continuing Legal Education, the Chicago Estate Planning Council, the DuPage County, Northwest Suburban, Greater North Shore and Lake County Estate Planning Councils, the Illinois CPA Society and the National Business Institute on the subjects of estate and trust administration, estate planning, elder law and Medicaid planning.