Divorce Law Alert - What You Need to Know About Debt and Divorce

05.09.16

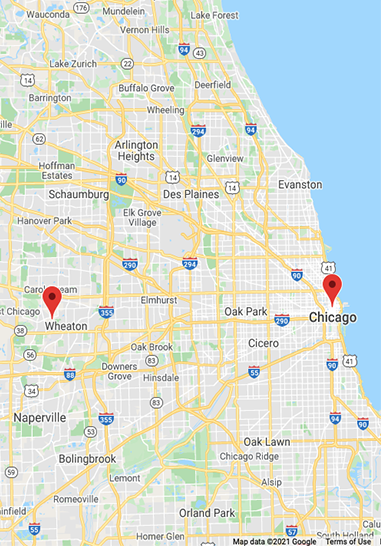

This Divorce Alert is brought to you by the Chicago Divorce and Family Law Attorneys at Aronberg Goldgehn Davis & Garmisa and Divorce Magazine.

By Zephyr Hill

Debt is an unfortunate part of many of our lives. As much as we try to minimize it, most of us have mortgages on homes, credit card bills, regular car payments, student loans and more than a few other areas where we owe money. When we get married, we accrue debt for two (more if there are kids involved). Even after the end of wedded bliss, monetary misdeeds can leave lasting scars on your finances. With that in mind, here are some things that may be helpful to know when it comes to debt and divorce.

How Debt Is Divided in a Divorce

Just as the assets are divided between two parties, so, too, is the debt. But where you live may impact how that plays out. In community property states, like Washington, California, and others, debt acquired during a marriage is viewed as the responsibility of both parties and can be split down the middle. While that may sound all well and good and equitable at first, this can include debts that you weren’t aware of. For instance, if you and your spouse have separate credit cards or bank accounts, or your soon-to-be ex purchased a big-ticket item without your knowledge or consent, you may find yourself on the hook for half of the amount owed.

Other states use equitable distribution to determine what each party owes, with the judge, attorneys and contestants hashing out the details and resolving the issue. When it comes to shorter marriages, the court attempts to ensure that each party exits the marriage at least in similar circumstances as they entered. In terms of longer unions, the consideration is to give each individual adequate tools and opportunity to rebuild.

While this may make community property states feel antiquated in that regard, that’s not exactly the case. The community property approach views marriage as an equal partnership and seeks to protect both parties uniformly. For example, if one parent quits a job to stay home with kids, this ensures that he or she is protected in the case of divorce and will not be left with nothing in the settlement.

In order to protect yourself against debts your spouse may have built up without your knowledge, full disclosure in financial matters is vital. Make sure that you find out about all the potential debt you face, whether it’s in your name or not. You may want to keep a detailed list of account numbers, how much is owed, and to where, and which one of you is responsible for each of these obligations.

Divorce Doesn’t Change Your Loans

Ending a marriage may alter almost every facet of your life, but it most definitely does not change any deals you made with third parties. If you and your spouse signed a mortgage, secured a car loan or established a line of credit while married, those terms remain in place and aren’t amended simply because of a divorce. The only terms a creditor must honor are the ones initially laid out, and if your name is on the dotted line, you remain responsible for them moving forward.

If your ex is ultimately ordered to cover a particular outstanding balance, or even a share, in the final agreement, but this doesn’t happen, it can have unpleasant ramifications. Creditors may come after you, it can negatively impact your credit score, and you may even face potential legal action. These are all headaches you don’t want or need as you try to move forward with your life.

One way to protect yourself in this situation is to refinance existing loans. Depending on the division of assets laid out in the final resolution, having your name removed from previously shared agreements can shield you down the road. For example, if your former spouse keeps a car or home that had both of your names on the paperwork, you may want to make sure that it is ultimately refinanced in his or her name alone. You can have this requirement written into the settlement to see to that it is completed by a certain date. Such provisions will protect you from potential missed payments coming back to bite you in the future.

Debt After Divorce

Divorce isn’t the end of debt. In fact, the process comes with a whole new set of financial obligations. There are court costs, legal charges, and attorney’s fees to take into consideration, all of which can be extensive and add up quickly. If there are minor children involved, the cost of child support, ongoing care and even secondary education may come into play. As do a number of other elements, including possible spousal support, the cost of moving into a new home, changes in health insurance and tax status, and having to pay all of the bills out of your single paycheck.

Even after the final divorce agreement is signed and all the pre-existing financial commitments are dealt with, it’s easy to fall back into debt. Embarking on a new chapter of your life, you don’t want to be saddled with the additional burden of owing tons of money.

Debt makes divorce even more complicated than usual, but there are ways to lessen its impact. Be aware of all the money owed that may come into play during a settlement. Whether it’s in your name, your spouse’s, or both, you’ll want to know what is due and where.

Your final divorce agreement is just that, an agreement. It is up to the parties involved to honor these terms. Make sure to take the appropriate steps to see that these conditions are met, and to safeguard yourself from any potential negative impact if they are not.